There’s an old saying that the only thing constant is change. Many of life’s changes are qualifying events that trigger special enrollment periods. The special enrollment period gives you exactly 60 days to get new health insurance, counting the date of the qualifying event as the first day.

In Colorado, Open Enrollment re-opens November 1st for plans with a January 1 start date. Open Enrollment closes again after January 15th.

After Open Enrollment, you can only enroll in most non-employer sponsored private health insurance plans only if you have a qualifying event. Generally speaking, most qualifying events are tied to your job or are due to changes in your life situation.

While what’s acceptable can vary from state to state and on and off-exchange, a few common examples of qualifying events that trigger a special enrollment period include:

- Getting married

- Becoming pregnant

- Having a baby and adopting or placement of a child

- Permanently moving to a new geographic area that offers different health plan options

- Losing other health coverage through a job, divorce, loss of eligibility for Medicaid or CHIP, expiration of COBRA health insurance coverage, or a health insurance plan being decertified

- For people already enrolled in coverage through one of the government exchanges, having a change in income or household status that affects eligibility for tax credits or cost-sharing reduction

- See many more examples of qualifying events for job changes and life changes

The timing of your application will also effect when new coverage begins. The 15th of the month is the cutoff date for a 1st of the following month effective date.

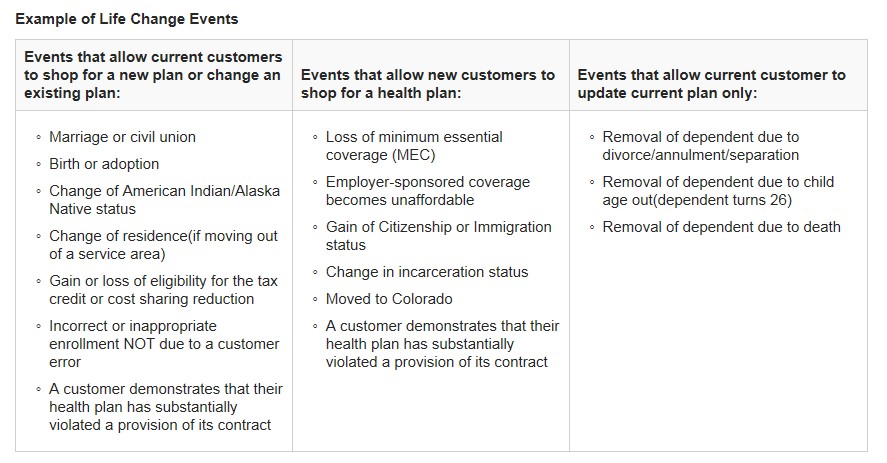

What is acceptable as a qualifying event can vary by state, by exchange and even by insurance carrier. As an example, in Colorado here is an aggregate list of off-exchange qualifying events from Colorado’s leading insurance companies. below is a chart from Connect for Health Colorado showing the few qualifying events they will accept. It’s always best to check with an experienced insurance broker in your state to help you evaluate the options both on-exchange and off the government run exchanges.

Please note that voluntarily dropping other health coverage or being terminated for not paying your premiums are NOT considered loss of coverage, so be careful that don’t let your insurance policies lapse. Losing coverage that is not minimum essential coverage (like a temporary health insurance plan or mini-med plan) is also not considered loss of coverage.

You can enroll in Medicaid or the Children’s Health Insurance Program (CHIP) in your state at any time—there is no open enrollment period for these programs.

It’s always wise to work with an experienced local health insurance broker to help you review both your on and off-exchange insurance plan options. They can help you determine which carriers will accept your qualifying event and which has the best value on health insurance. There is no extra charge for their professional services. Colorado consumers please click here.

1 comment for “Special Enrollment Periods”